Chinese NEV Policies Drive Transition Toward More Advanced Batteries

By Jason Li

Changes in subsidies for new-energy vehicles (NEVs) in China have significantly altered the country’s electric-vehicle battery industry. By incentivizing increased battery energy density and vehicle range, Beijing promoted a rapid transition from lithium ferrophosphate (LFP) batteries to ternary lithium batteries.

An LFP battery is a type of rechargeable battery that uses lithium ferrophosphate as the cathode material, while a ternary lithium battery uses a compound of nickel, manganese, and cobalt. Compared to traditional LFP batteries, ternary lithium batteries have higher energy intensity, a high-voltage platform, and better low-temperature performance. Despite the technological superiority of ternary batteries, Chinese battery makers were late to develop them due to high manufacturing costs, low demand from domestic NEV makers, and higher technical standards compared to their foreign counterparts such as Panasonic, Samsung, and LG SDI. Prior to 2017, all of BYD’s bestselling models in China were powered by LFP batteries. In 2017 and 2018, the Chinese government modified NEV subsidy policies to promote higher battery energy density and longer vehicle driving range, which led Chinese NEV makers to install ternary batteries in their newest models. The increasing demand spurred domestic battery makers, including CATL and BYD, to develop and manufacture ternary batteries.

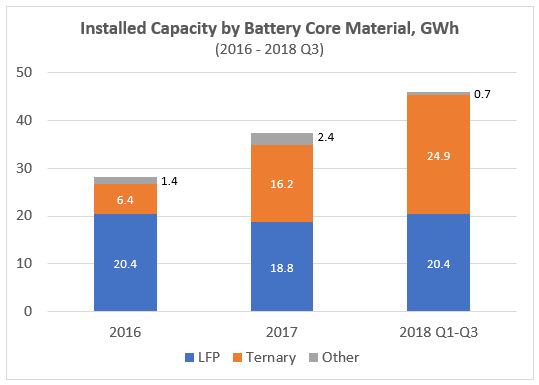

The figure below shows that the installed capacity of ternary lithium batteries in Chinese NEVs—measured as both absolute installed capacity and market share—has dramatically increased since 2016. From January to September 2018, these batteries made up 54.1% of the installed capacity of new NEVs sold in China, as compared to 43.5% in 2017 and 22.8% in 2016. The absolute installed capacity of NEVs with ternary lithium batteries nearly quadrupled from 6.4 GWh in 2016 to 24.9 GWh in the first three quarters of 2018. These NEVs account for almost all growth in NEV sales across China from 2016 to 2018.

While ternary lithium batteries offer increased energy density, they are more expensive than LFP batteries, which may pose problems for the Chinese government as it attempts to keep NEV prices down while decreasing overall subsidies. Another concern is product safety at high temperatures. Ternary materials can dissolve and create a fire hazard at temperatures of 200 °C (392 °F), which is much lower than that of LFP batteries. For this reason, the Chinese government restricts the application of ternary batteries to electric cars. Regardless of these drawbacks, the subsidies for energy-dense and long-range NEVs are driving the development of more sophisticated energy sources and establishing ternary batteries as the first choice of vehicle producers in the world’s largest NEV market.

To learn more about the development of NEVs in China, read the latest CIPS report, China’s Risky Drive into New-Energy Vehicles, by Scott Kennedy.

Jason Li is a Research Intern with the Freeman Chair in China Studies at CSIS.